How advisors can strengthen trust, personalize service, and meet client expectations in a tech-forward world.

Orion Advisor Solutions partnered with Logica Research to conduct their inaugural 2025 Investor Survey. They surveyed 1,000 investors with a minimum of $50k investible assets and learned key insights on investor satisfaction, technological preferences and communication expectations.

Key Findings

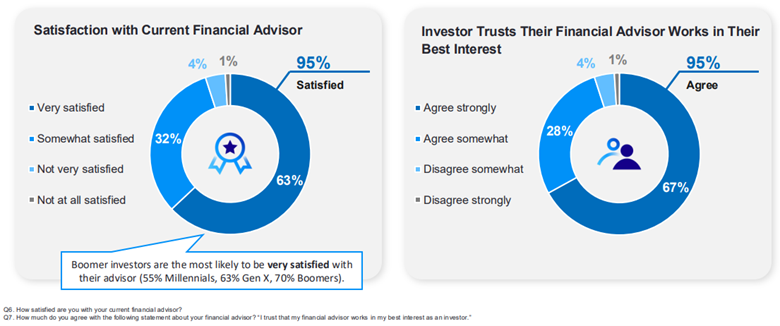

High Levels of Satisfaction and Trust:

95% of investors expressed satisfaction with their financial advisors; 67% strongly agreeing they trust their advisor is acting in their best interest.

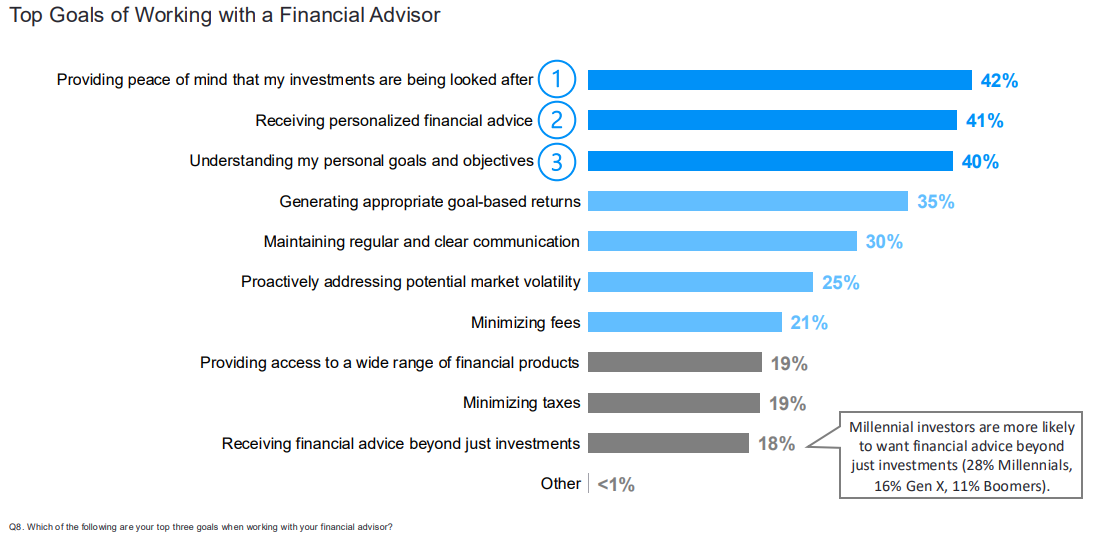

Top priorities are peace of mind and personalized advice:

42% say peace of mind regarding their investments is their top priority, 41% say personalized financial advice, and 40% say advisors understanding their goals and objectives is their top priority.

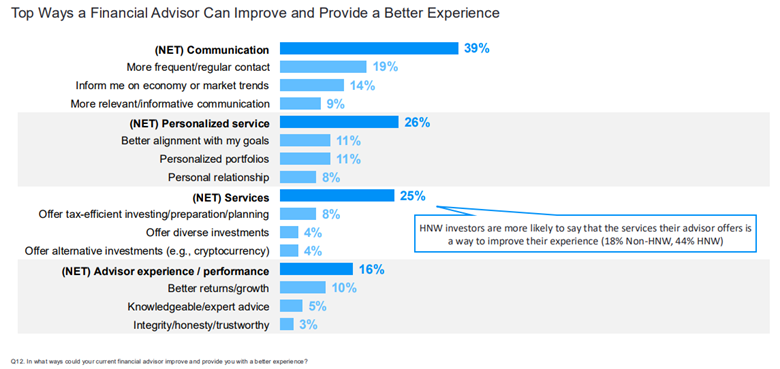

Improving communication is the top way advisors can provide their investors with a better experience:

39% report improved communication would improve their relationship and communication with their advisor, 26% said personalized service, 25% said services offered and 16% said advisor experience / performance.

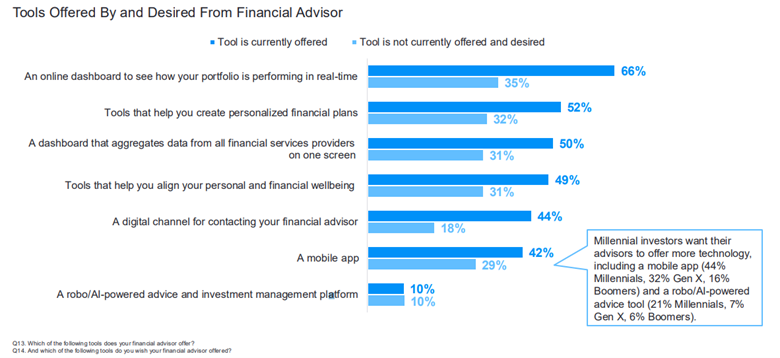

Preference for technology:

Investors appreciate modern, investor-centric technology. Voiced preference for online dashboards that display real-time portfolio performance.

Prefer traditional methods of communication:

Although they use various methods of communication, tradition methods of phone calls and in-person meetings were more preferred versus emails or video calls.

What this means for advisors:

Increase personalized services:

Investors want peace of mind and to know their investments are being looked after. Focus meetings on investment details versus other topics.

Leverage technology effectively:

If you’re not already using one – it’s time to implement user-friendly, real-time online dashboards. This can help meet client expectations as well as provide transparency.

Adapt communication strategies and frequency:

Investors prefer meeting at least quarterly – if not more. Pay attention to your communication methods and frequency and adapt to investor preferences.

Read the full survey report for even more insights. Taking advantage of the study findings can help you proactively address your clients and build a long lasting, trusting client advisor relationship.